Borrowing emergency cash has become more affordable and repayment terms have become longer! So don’t lose out on saving more while enjoying repayment flexibility. Apply for easy approval installment loans from direct lenders only such as NetCashMan. You could be approved with a 3-minute-long application that does not entertain any paperwork or faxing. That means your loan approval is instant and funds will be deposited in your account on the same day.

How our Installment Loans Work

1. Easy application

Complete our online application, it’s quick, easy and confidential.

2. Fast Lender Decision

If you are approved, e-sign and complete instant bank verification

3. Get Your Funds

Funds deposited into your account the following business day.

4. Repay your loan

Customize repayment plans with affordable payments.

Say no to Third Party Payday Lenders

Borrow money online from a direct lender with fast approval

Advantage of Online Cash Advance Loan with us

Ease and Simplicity

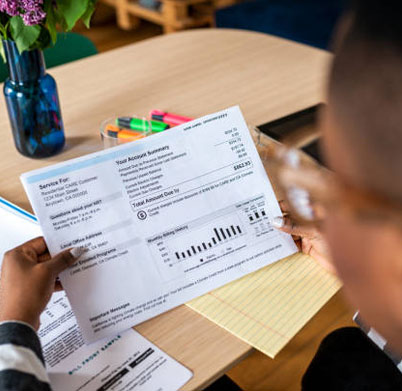

Applying for an emergency loan can be a frightening experience. It involves standing in lines, faxing documents, meeting tight requirements, waiting for approval, pledging your assets as collateral, and more. Traditional bank loans for personal use can be extremely difficult to get. However, at Net Cash Man, we value your time and completely understand your urgent need for short term money. We offer a fast, online application process.

Why Net Cash Man

We understand you have a choice when it comes to financial products.

At Net Cash Man, we make serving you the priority and strive to ensure that our loan application process is as simple, fast, and transparent as possible.

At Net Cash Man, we make serving you the priority and strive to ensure that our loan application process is as simple, fast, and transparent as possible.

Most Credit Types Welcome

Even if you have had credit challenges, we look at other factors to ensure you get the funds you need.

Affordable

We will customize a payment program for you based on your needs.

Personalized Service

Our agents will work with you during the loan process, and afterward for any customer service need.

Net Cash Man Installment Loans

For Whatever Life Throws Your Way